Low cocoa prices and income for cocoa farmers

A few corporations dominate the processing of cocoa and the production of chocolate. Mars, Mondelēz, Nestlé, Ferrero, Hershey's and Lindt & Sprüngli alone control around 55 percent of the global chocolate market. The chocolate industry's global net sales are around $110 billion a year. The few large retailers and discounters also play a role that is not be underestimated. The market share for chocolate bars is around 28% for retailers' own brands in Germany.

Unequal distribution of power

This market power of a few companies, is in a juxtaposition tothe limited influence of the around 5.5 million small farmers. For most of them, cocoa cultivation is by far the most important source of income. However, the farmers have almost no influence on pricing. Pricing is based on global supply and is also influenced by trading on international commodity exchanges in London and New York.

For every euro of the retail price that consumers in Germany pay for a bar of chocolate, only about eight cents go to the cocoa farmers. This amount is far too low to live a decent life on. While all other actors in the chocolate supply chain make profits, most cocoa farmers are unable to cover their costs of production and livelihood. The majority of cocoa farming families live in poverty.

However, the unequal distribution of profits also means that doubling the income of cocoa farmers does not necessarily mean that the the price of chocolate has to double.

Low and volatile cocoa prices

For a long time, the cultivation of cocoa was considered a guarantee of a secure income in West Africa. However, since the 1980s, the price of cocoa has fallen by almost half, (adjusted for inflation). A high price volatility leads to low planning and income security for cocoa farmers. Within a few months between mid-2016 to the end of 2017 alone, the world market price of cocoa fell by 40%. Due to a record harvest in Côte d'Ivoire, the supply of cocoa beans exceeded demand at the time, causing the price to plummet.

The falling cocoa price had dramatic consequences in cocoa growing countries: Farmers suffered major income losses. In Côte d'Ivoire, government spending even had to be cut by almost ten percent because of the loss of export revenue.

Abrupt changes in world market prices can have many causes: Crop failures due to disease or pest infestation, unfavourable weather conditions, slumps in demand as seen recently during the Corona pandemic, political unrest in the growing regions, or the global effects of, for example, the war in Ukraine. Speculations on commodity exchanges, - deliberate acts by market trades to make profits - , also contribute to fluctuating cocoa prices. While volatile prices may cause existential disaster for smallholder farmers, big companies are able to better cushion the effects ofprice fluctuations.

What is a fair price?

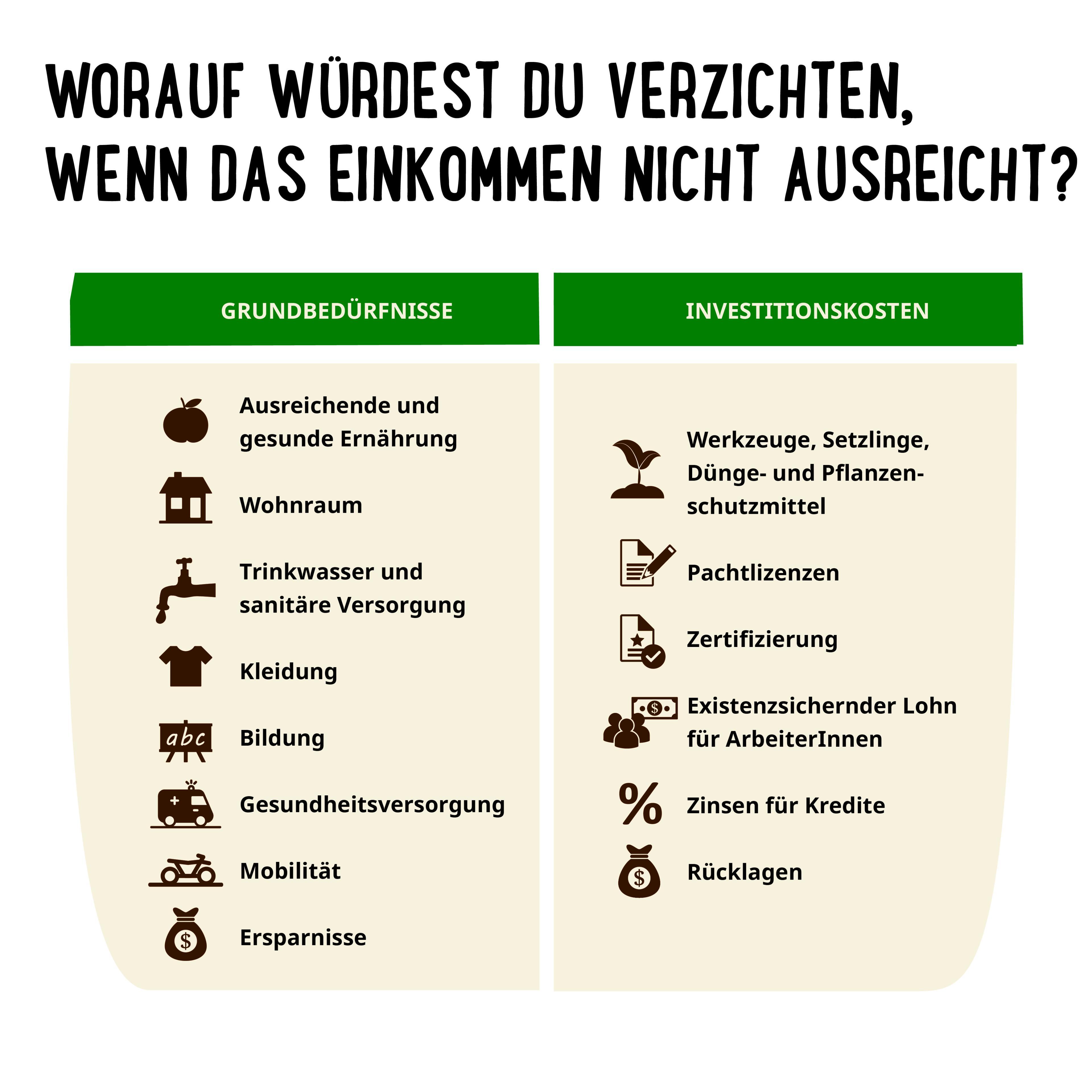

The cocoa price is only fair if it enables cocoa farmers to earn a living income. A living income must cover the basic needs of cocoa farming families. These include adequate housing, healthy and sufficient nutrition, clean drinking water, appropriate health care, education, mobility and the ability to build up savings for unforeseen events such as crop failure or illness. Hower, a living income must also cover farmers’ investment costs in the cocoa plantation.

How much a living income amounts to and a corresponding living income cocoa price must be differs depending on the cultivation region and is influenced by many factors: the size of the cultivated area, the number of family members per household and the dependence on cocoa cultivation all play a role.

The Fairtrade certification organisation has calculated a living income refrence price for cocoa. Cocoa farming families in Côte d'Ivoire with sufficiently large plots and have adequate yields should receive farm-gate-price of 2,390 US dollars per metric tonne of cocoa. In fact, the national farm-gate price guaranteed by the government in Côte d'Ivoire is currently around 1,344 US dollars per metric tonen (as of October 2022). INKOTA considers the price calculated by Fairtrade to be too low, as itscalculation is based on too high harvest yields per hectare.

Most cocoa farming families live below the poverty line

A typical cocoa farming family in Ghana with six members and up to four hectares of land earns an equivalent of 191 U.S dollars per month on average. By contrast, an income of around 395 U.S. dollars - i.e. a little more than twice as much - would be needed to secure a living income.

The situation in Côte d'Ivoire is even more dramatic: Here, incomes would have to almost triple on average in order to provide a living income.

Income gaps in cocoa farming

Cocoa growing countries regulate cocoa prices

In the two main cocoa-growing countries, Côte d'Ivoire and Ghana, the cocoa price is set by the state. At the beginning of the harvest season, the relevant marketing boards set the guaranteed price that must be paid to cocoa farmers. The marketing boards base their price in accordance to the world market price. One of the strengths of this model is that it offers farmers greater stability and enables them to plan ahead with certainty. In order to increase the government-guaranteed cocoa price, both countries have been charging a price premium of 400 U.S. dollars per ton for their cocoa since October 2020: the so-called "living income differential," which the industry must pay in addition to the world market price. However, the process for setting the price is intransparent, as are government expenditures and subsidies in the cocoa sector. Cocoa farmers have had hardly any influence on either in the past. INKOTA therefore supports local non-governmental and producer organizations in Ghana and Côte d'Ivoire to engage in political dialogue for a sustainable and more transparent cocoa sector.

Here, you can learn more about the work of Ivorian and Ghanaian civil society in the cocoa sector..

Which companies pay fair cocoa prices?

Even with cocoa certified as fair or sustainable - for example by Rainforest Alliance or Fairtrade - the situation in West Africa does not look much better: Although certified cocoa farmers receive additional premiums, the majority of them still live below the poverty line. As of now, none of the eight largest chocolate companies is willing to pay living cocoa prices.

However, companies such as Tony's Chocolonely, GEPA and fairafric show that it can be done differently. They all pay significantly higher prices and premiums and are considered pioneers for sustainability in the chocolate sector.!

More information:

- Info sheet 1: The bitter truth about chocolate (German, PDF)

- Info sheet 3: Certified chocolate. What is behind the seals? (German, PDF)

- Info sheet 6: GEPA, Fairtrade and Tony's Chocoloney in comparison (German, PDF)

- Cocoa Barometer 2022 (English, PDF)

- Study on profit distribution in the chocolate supply chain in Germany (English, PDF)